19 Mrz Compound Interest In Forex Currency Trading

Contents:

In international https://forexarena.net/s, the difference in the interest rates of two distinct economic regions. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. However, news and surprise announcements can have an immediate impact on rates which, in turn, can affect forex prices.

Now, I will demonsthttps://forexaggregator.com/ how to use the online Forex compounding calculator. We enter the same input data as we used for the manual calculation. The initial deposit is 100 USD, the expected monthly profit is 5%, the investment period is three months. The central bankers decide to increase or decrease interest rates based on several economic data points.

Forex Compounding Plan! – Forex Compounding Strategy Example

They’re what investors use to determine if they’ll invest in a country or go elsewhere. This occurs because setting high interest rates normally forces consumers and businesses to borrow less and save more, putting a damper on economic activity. It’s generally accepted that moderate inflation comes with economic growth. Inflation is a steady increase in the prices of goods and services.

To do so, all you need is to follow what is called forex compounding plans. If you compare this with a non-compounding investment, it would result in only $120 since you would get a fixed $10 profit per each year. Whether the base currency for your trading is US dollar, UK pound, Euro or any other currency, you’ll find our forex compounding calculator works for you.

Current Account Vs Savings Account – Forbes Advisor INDIA – Forbes

Current Account Vs Savings Account – Forbes Advisor INDIA.

Posted: Tue, 17 May 2022 07:00:00 GMT [source]

When this happens, a trader should understand in which direction the market will move. If there is a rate cut, traders will probably sell and buy currencies with higher interest rates. Each central bank’s board of governors controls the monetary policy of its country and the short-term rate of interest at which banks can borrow from one another. The central banks will raise rates in order to curb inflation and cut rates to inject money into the economy and encourage lending.

How To Trade Compound (COMP) In 2023: A Step-by-Step Guide

To calculate the balance total gain from Forex pairs trading with reinvestment, you can build an Excel model. But it is easier to use a calculator that already has this model. Calculate compound Forex interest earnings based on increasing the deposit balance by adding the profit received. The trader calculator also calculates the yields, including withdrawals or depositing. Many forex traders use a technique of comparing one currency’s interest rate to another currency’s interest rate as the starting point for deciding whether a currency may weaken or strengthen. If a trader expects the US to unexpectedly hike interest rates he/she anticipates the US dollar may appreciate.

This is still the “slow growth” period for your trading account and the toughest period for any trader. Investing in currency may be new territory and it’s important to understand the ins and outs of how it works. The more you know, the better for making informed decisions when making currency trades. The daily reinvest rate is the percentage figure that you wish to keep in the investment for future days of compounding.

You can see a 1% compounding effect graph which is shown with a grey line at the bottom. The best compound effect graph is the one below where you can see how three different compounding effects have different results. Compound interest is the eight wonders of the world with exponential return where you reinvest what you have earned. To give you a rough overview of how that would look on a weekly basis check this out. If I open 1 trade per day throughout the week I will make 5%. You see, after making $200 after the first month you will make $216,49 after the fifth month.

The 8 Best Low Risk Investments For February 2023 – Investor Junkie

The 8 Best Low Risk Investments For February 2023.

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

Most amateur traders make some calculations and then get too excited about where they could be in 100, 200 or 500 trades. But back in reality they get frustrated because their $2,000 account is not producing the returns they are after. After some more trades, your account is now at $20,000 and the 1.3% are now worth $260.

Compounding Plan Strategy

Forex Compounding Calculator is thetoolthatcalculatestheprofitof next trade withprofit addedfrom previous trade to the initial account balance. Have in mind that Forex calculator compound works with profit only. If you lose money in one time period the table with results will not be valid. High leverage or margin trades in forex means you could lose more than your initial investment.

The compound interest plan goes down the pan, when you need money to eat. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade. But throughout all that time we’ve remained steadfast, providing traders with the stability and opportunities they need to make their mark on the financial markets. For instance, if the pound is rising against the dollar, you might buy GBP/USD. When you buy this pair, you’re buying pound sterling by selling the US dollar . Then, if the pound continues to outpace the dollar, you can sell the pair to exchange your GBP back for USD and keep the difference as profit.

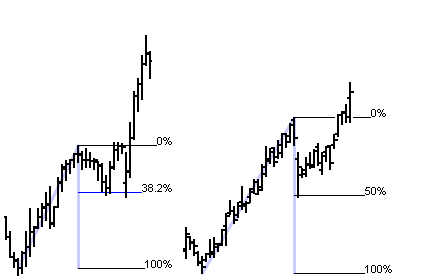

Determine significant support and resistance levels with the help of pivot points. Compound interest makes your money work diligently for you, continually FEEDING UPON ITSELF to grow at a substantially faster rate than with simple interest. The interest rate decisions themselves tend to be less important than the expectations for future interest moves. Interest rate differentials are simply differences in interest rates between two countries. Of the interest rate which can have a large effect on the currency. The real interest rate is the nominal interest rate less inflation.

Initial Balance

If an offer from a company that facilitates currency trading sounds too good to be true, it probably is. Watch out for offers of huge returns on relatively small investments. For example, the currency pairs of the U.S. dollar with the euro may be quoted in reverse order–(EUR/USD), which means one euro purchases a specific amount of U.S. dollars. If you trade currency, you’ll do it on the foreign currency exchange or Forex market.

- When you trade Compound, your broker will require you to enter a stake amount.

- Therefore, it’s important to understand how to predict and react to them in your quest to secure profits.

- However, it can be done, provided that you do some homework to build a good plan and stick to it.

- While interest rates change with the gradual shift of monetary policy, market sentiment can also change rather suddenly from just a single report.

It’s important to be aware that compounding doesn’t necessarily need to be from trade to trade. Compounding can also be managed through a running long term trade where you hold positions and you know when your trade has gone to key price levels that are confirmed to not return. However, while you’re profitable in the midst of compounding your trades, it is important to understand how your profits were made. This implies and means that there are many different ways to create profit but for the purposes of compounding, you should be having profit by a systematic method. If you use compounding growth calculators on each trade then you can have several trades per day and after each trade you can grow your account.

Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. You might want to add your own view on economic fundamentals as a filter, perhaps by slightly increasing the size of any trade entries that are in the same direction as your fundamental outlook. For example, it has been shown that currencies with higher interest rates tend to rise against currencies with lower interest rates, at least over the short-term. Time-based exits can work surprisingly well, usually with scaling. For example, take partial profits at 1 month from entry, 3 months, 6 months etc. This can also help limit losses, where the price is below the entry level after 48 hours, but has not yet hit the stop.

In conclusion, https://trading-market.org/ Compounding Plan is a great way to make significant returns in the foreign exchange market without taking excessive risks. By investing small amounts of capital regularly and allowing profits to be reinvested, traders can gradually build their capital base over time. This approach reduces both the risk of large losses due to fluctuations in the market, as well as the need to source additional funds from outside sources. Furthermore, compounding forex trading profits allows traders to track their investments effectively and make intelligent decisions about when to enter or exit trades. Ultimately, this makes Forex Compounding Plan an attractive and viable option for investors looking to gain long-term financial success in the foreign exchange market.

If you are not in favor of withdrawing that amount, and that amount can also remain in the account completely, or you can take out a percentage from it. For this reason, the more prudent approach of compound interest with conservative financial instruments can bring a sense of balance to your forex trading strategy. It works by simulating the compounding, in other words, the reinvesting, of the chosen gain percentage of the account’s total equity. The constant withdrawal of set gain percentage in Forex at least up to an amount equal to the starting capital minimizes risks. How much more will you earn with the reinvestment strategy, and does it make sense to risk and not to withdraw the money from time to time.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

You could actually derive more profit if you were able to obtain and hold the actual bonds, but you would also need to have enough cash to cover the face value purchase. Now applying that to Forex, the compounding is the method that is best suited to trading strategies that can take positive pips over time, regardless of the size of the position you place on the trade. For example, if all your trades were 1 standard lot over time, you would end up being profitable over the trading period.